Free Tips On Deciding On Prague Gold Price

Wiki Article

What Should I Think About Prior To Investing In Gold Coins/Bullion?

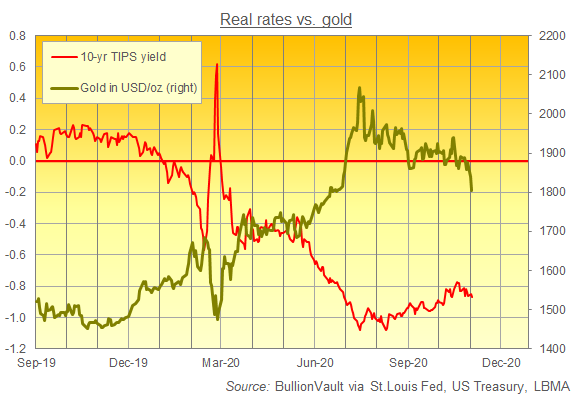

Learn about the tax implications purchasing and selling gold in the Czech Republic. The tax laws could differ for investment gold and impact your return. Market Conditions: Monitor market trends and fluctuations in the price of gold. This will allow you to make informed choices about the best time to invest.

The authenticity of the Bullion and Gold Coins- Make sure you ensure that any gold coins you buy are authentic and include all necessary documentation.

Set out your investment goals. Determine if you're purchasing gold to secure your wealth in the long-term, diversify your portfolio, or hedge against the effects of inflation and economic uncertainty.

Consultation and Research- Seek advice from financial advisors or experts in precious metals investment. Make informed investments by conducting thorough research on the market for gold.

Gold can be an excellent investment. However, you must be sure to approach any investment, including precious metals with careful research and consideration. It is also important to understand your goals in terms of financial and risk tolerance. Read the recommended related site on Gold Czechia for website advice including saint gaudens double eagle, canadian gold maple leaf coin, 1 0z gold price, gold etf, barrick stocks, 1oz gold eagle coin, gold and coin shops near me, maple leaf gold coin, gold quarter dollar, ngc grading and more.

What Can I Do To Ensure The Quality Of Gold I Purchase In Czech Republic Or Bullion?

Ensuring the authenticity and proper documentation of bullion and gold coins in the Czech Republic involves several steps to confirm their legitimacy.-

Hallmarks and certificatesSearch for the stamps or hallmarks recognized by the federal government for the gold product. These hallmarks indicate the purity, weight, and authenticity of the gold. They are typically provided by reputable assay offices or institutions of government. Verify the gold's purity by checking for marks that indicate the quality or karatage. A gold piece that weighs 24karats is considered to be pure. Lower levels of karatages indicate different levels of alloys or levels.

Reputable Dealers: Purchase gold from reputable and established dealers. These sellers often offer proper documents, such as authentic certificates and receipts detailing the specifications of gold.

Get documentation you're purchasing gold, request the certificates of authenticity or of assay. These documents should include information about the gold's weight as well as the purity, manufacturer and the hallmark.

Independent Verification- Ask for an independent verification or appraisal by a third-party expert. They will be able to verify the gold's quality and assess its authenticity.

Verifying authenticity involves doing the necessary research. Making sure you are buying from reputable sellers and having the correct documentation is essential to ensure you're purchasing genuine, high-quality bullion. Have a look at the top Charles III gold bullion hints for site tips including buying gold, gold coin values, gold and silver dealers, noblegoldinvestments, ngc grading, gld spdr gold shares, 1 10 oz gold coin, gold coins, $20 gold coin, price for one ounce of gold and more.

What's The Main Difference Between A Lower Spread On Gold And A Lower Markup For Stock Prices?

A low price spread and markups that are low are words that are used in connection with the gold market to mean the costs involved in buying or selling gold relative to the market value. These terms define how much you'll be charged for gold, either as either a mark-up or spread. Low mark-up: This is a tiny amount that the dealer is able to add to the gold market price. Low markup indicates that the cost of gold that you pay for is barely higher than its actual market value.

Low Price Spread - The spread is the difference between the buying (bid) and selling (ask) prices for gold. A spread that is low means that there is a gap between these prices.

How Much Does The Price Difference And Markup Among Gold Dealers?

Negotiability. Some sellers may be more inclined to negotiate mark-ups on prices and spreads particularly if the deal is substantial or if they have a history of returning customers. Geographical location. Mark-ups can be affected by local regulations and taxes and regional influences. Dealers operating in areas where taxes and regulatory costs are more expensive may pass these expenses on to their customers through increased the markups.

Product Types The spreads and markups will vary based on the supply of gold products. The rarity of collectible or rare objects could lead to greater markups.

Market Conditions – In times that are characterized by increased volatility, high demand, scarcity or market volatility, traders can increase their spreads in order in order to limit or cover any potential losses.

In light of these factors it is imperative that gold investors do their research, compare the prices of different dealers, and consider other factors in addition to spreads and markups. They should consider reputation, reliability, service and customer satisfaction. It is important to search to get quotations and compare prices from various dealers. This will help you to find the most competitive price on gold. View the recommended Britannia coins for more recommendations including purchase gold, cost of silver coin, double eagle gold coin, gold 1 dollar coin, gold and silver bullion, 1 oz gold eagle, gold eagle coin price, gold coins for sale near me, gold dollar coin, gold coins near me and more.